What is the payment term for purchasing Electrolytic Tin Plate from China?

In my 27 years of dealing with global buyers, I have seen countless deals fall apart at the last minute. It was not because of the price. It was not because of the quality. It was because the buyer and the seller could not agree on how to pay. Sending a large amount of money to a foreign country is scary. I understand that fear.

The standard payment term for purchasing Electrolytic Tin Plate (ETP) from China is usually Telegraphic Transfer (T/T). This typically involves a 30% deposit when you confirm the order, and the remaining 70% balance paid before shipment or against a copy of the Bill of Lading. For larger orders, an Irrevocable Letter of Credit (L/C) at sight is also a widely accepted method.

If you are planning your first order or looking to improve your cash flow 1, you need to understand the logic behind these terms. Knowing how to negotiate these terms can save you money and protect your business from huge risks.

Can I pay via Irrevocable L/C to ensure my funds are safe?

When you are dealing with a new supplier, trust is a major issue. You do not want to send cash to a factory you have never visited. You worry that they might take the money and not ship the goods. This is a very common feeling among purchasing managers.

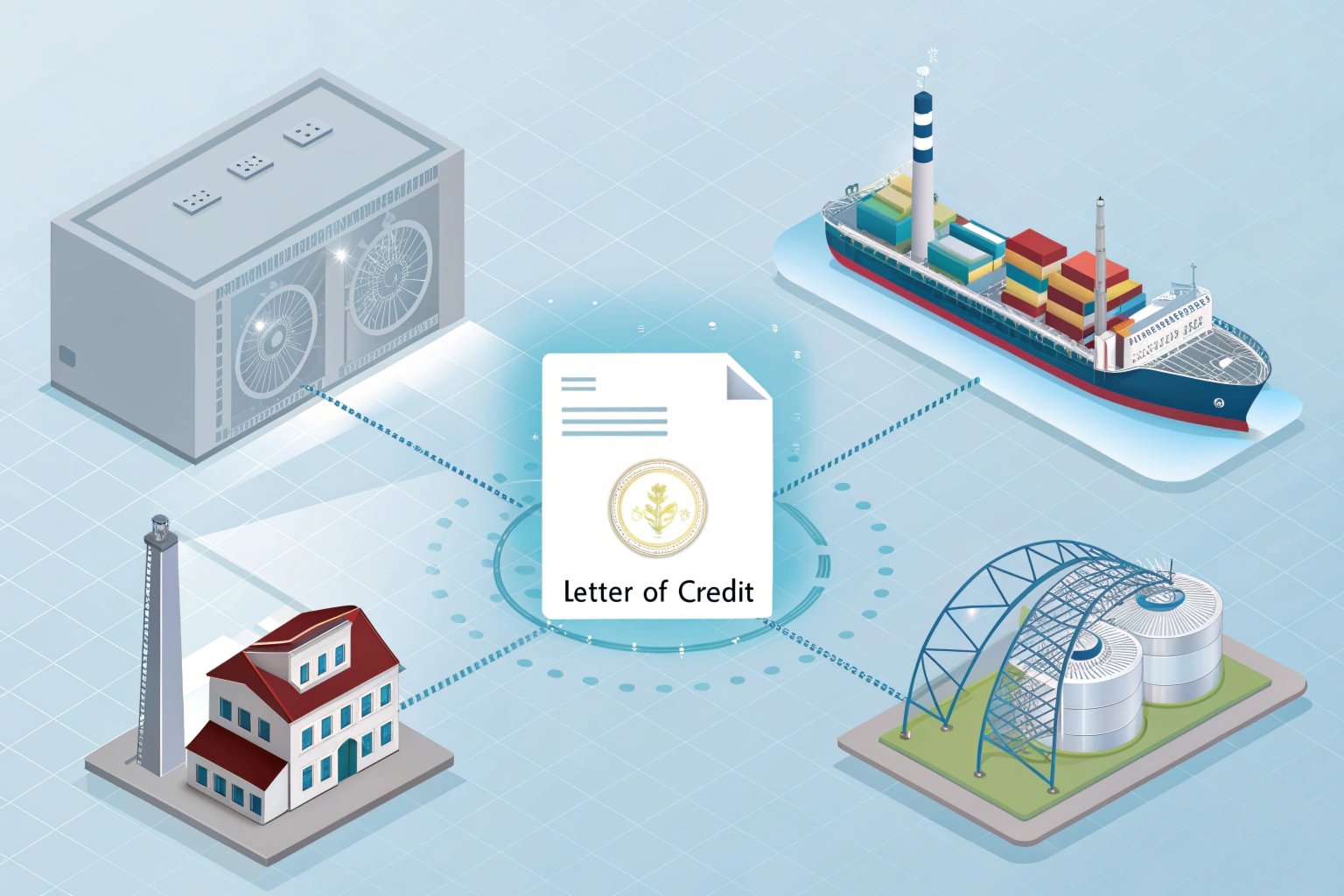

Yes, almost all reputable tinplate manufacturers in China accept Irrevocable Letters of Credit (L/C) at sight, especially for orders exceeding $50,000. This method uses bank credit as a guarantee. The bank only releases your money to the supplier after they provide compliant shipping documents, ensuring your funds are safe.

For bulk raw materials like tinplate 2, the Letter of Credit (L/C) acts as a safety bridge between us. At Huajiang, I often work with cautious clients like Carlos. He cares deeply about product quality, but he cares even more about the safety of his company’s capital.

The Trade-Off Between T/T and L/C

In the real world, many buyers struggle to choose between T/T and L/C. T/T (wire transfer 3) is cheap and fast. However, it puts more risk on you, the buyer. You have to pay cash before you see the goods. On the other hand, L/C is very safe. But it comes with high bank fees. It also requires strict paperwork. A single spelling mistake can cause a "discrepancy" 4. This leads to delays and extra costs.

To help you decide, I have created a comparison table based on my experience:

| Feature | T/T (Telegraphic Transfer) | L/C (Letter of Credit) | Best Scenario |

|---|---|---|---|

| Cost | Low (Only wire fees) | High (Opening fees, discrepancy fees) | T/T for old partners or small orders. |

| Buyer Risk | High (Prepayment risk) | Low (Bank guarantees payment) | L/C for new suppliers. |

| Seller Risk | Low (Production starts after deposit) | Medium (Must ensure perfect docs) | Large deals where both sides are reputable. |

| Cash Flow | Ties up 30% cash immediately | Uses bank credit line | Buyers with tight liquid cash. |

Why Do Some Factories Resist L/C?

You might notice something strange when sourcing from China. When you ask to pay by L/C, some smaller factories might hesitate. They might even refuse. This is usually not because they want to cheat you. It is because they have limited cash flow.

The cycle for L/C is long. From the moment we ship the goods, to submitting documents, to the bank reviewing them, to finally receiving the money, it can take 20 to 30 days. In the steel industry, raw material prices change every day. Factories need cash quickly to buy more steel coils. Small factories cannot afford to wait a month for their money.

At Huajiang, we have strong financial backing. We fully support L/C payments. We understand that for a first collaboration, this is the only way you can sleep soundly at night. We even have a dedicated team to handle the paperwork. They work directly with your bank to ensure every document is "clean." For orders larger than 10 containers, I actually recommend L/C to my clients. It reduces the stress for both of us.

Do you require a 30% deposit for customized printed orders?

Imagine you want to order tin cans printed with your specific brand logo and colors. You ask for a quote, and the supplier asks for a large cash deposit upfront. You might feel this is unfair. You might feel you lose leverage if you pay so much before production begins.

For all customized printed tinplate or cut-to-size orders, factories must require a deposit of at least 30%. This covers the cost of making printing plates and buying raw materials. More importantly, if the order is cancelled, printed tinplate cannot be resold to anyone else. The deposit is the factory’s only protection against total loss.

This is a harsh reality of our industry. "Plain" tinplate (the silver sheets) is like currency. If you do not want it, I can sell it to another can maker. But once I print your logo on it, or cut it to a weird size, it becomes "dead stock."

The Hidden Costs and Asymmetric Risk

Let’s dive deeper into why 30% is the absolute minimum line. When you place an order for printed sheets, we do not just put metal into a printer. There is a massive amount of preparation work.

First, there is the plate-making cost. We need to create specific PS plates or CTP plates 5 for your design. If you have a complex 4-color or 6-color design, this initial investment is significant. We have to pay for this before a single sheet is printed.

Second, there is the coating preparation. Depending on what you will put inside the can, we need to mix specific coatings. Is it for tomato paste (high acid)? Is it for fish (high sulfur)? We mix these chemical coatings specifically for your order. We cannot put them back in the bottle once mixed.

Third, and most critical, is the opportunity cost. Once we schedule your printing job, that production line is booked. We turn away other orders to make space for yours.

Why the Risk is on the Supplier

Consider this scenario. We produce 5 containers of Easy Open Ends 6 printed with "Carlos’ Premium Sardines." Just before we ship, you face a market issue and cancel the order. What can I do with these lids? Can I sell them to a customer in Thailand? No. They have your name on them. Can I sell them to a local factory? No.

The only place those lids can go is the scrap yard. We would have to sell high-quality tinplate as scrap metal. We would lose the cost of the steel, the tin, the coating, the printing ink, and all the labor. The loss would be enormous.

To be fair to both sides, we use a tiered deposit structure:

| Product Type | Recommended Deposit | Balance Payment | Risk Analysis |

|---|---|---|---|

| Standard Size Plain Sheet | 20% – 30% | Before shipment or Copy of B/L | High liquidity. Easy to resell. Low risk. |

| Custom Size Plain Sheet | 30% | Before shipment | Harder to resell due to unique size. |

| Printed / Lacquered Sheet | 30% – 50% | Must be paid before shipment | Zero resale value. Highest risk. |

| Easy Open Ends (EOE) | 30% | Copy of B/L | Standard sizes, but internal coatings vary. |

So, when I insist on a 30% deposit for your printed order, please do not be offended. It is not about greed. It is about commitment. This deposit locks in the steel price for you. It guarantees the production capacity. It proves that we are both serious about finishing this transaction.

Can we negotiate O/A terms after we establish a long-term relationship?

Running to the bank to send a wire transfer for every order is annoying. It consumes time and fees. You also have cash flow pressure. You might wish you could pay 30 or 60 days after the goods arrive, just like you do with your local domestic suppliers.

Yes, negotiating Open Account (O/A) terms is entirely possible after we build a stable relationship and pass a credit assessment by Sinosure. This allows you to pay 30 to 90 days after shipment, significantly freeing up your cash flow. However, this requires high financial transparency and a perfect payment record.

This is the ultimate goal for every professional procurement director: using the supplier’s money to do business. At Huajiang, we support this win-win model. It transforms us from simple traders into strategic partners.

The Critical Role of Sinosure

Many overseas buyers do not know how Chinese suppliers can afford to offer credit. We are not banks. We do this with the support of the China Export & Credit Insurance Corporation 7, also known as Sinosure.

If you want O/A 30 days or O/A 60 days, we do not just trust you blindly. We follow a strict process:

- Application: You provide your company registration, tax ID, and banking details.

- Investigation: We submit this to Sinosure. They use global credit channels to investigate your company. They check your payment history, your legal status, and your financial health.

- Approval: Sinosure gives us a "Credit Limit." For example, they might say we can insure up to $1 million for your company. This means if you default, the insurance company pays us 80% to 90% of the loss.

How to Improve Your Chances for O/A

Not every client gets approved. I have seen big companies get rejected because they had a messy payment history. To get approved for O/A, you need to show strength.

- Payment Punctuality is King. If we work together on T/T terms first, make sure you pay exactly on time. If you delay payments constantly, your credit score drops. Sinosure sees everything.

- Financial Transparency. For large credit limits, providing audited financial reports 8 helps immensely. It shows you have nothing to hide.

- Stable Volume. If you order sporadically, it is hard to justify a credit line. Regular, monthly orders give us the incentive to pay the insurance premiums to keep your line open.

The Cost of Credit

You must understand that O/A is not free money. It costs us money to offer it to you. We have to pay insurance premiums to Sinosure. We also lose the interest we could have earned if the money was in our bank.

Therefore, the unit price for an O/A order is usually slightly higher than a T/T cash order. It might be 1% or 2% higher. You are effectively paying a small fee for the financing.

As a supplier, I value safety more than speed. If you are a buyer like Carlos, with 25 years of experience and a solid reputation, I am happy to apply for an O/A limit for you. This allows you to stock up heavily during the harvest season without breaking your bank account. It also allows me to lock in your orders for the whole year. It changes our relationship. We stop being strangers fighting over terms. We become partners fighting for market share together.

How do currency exchange rates affect my final invoice value?

The exchange rate between the US Dollar and the Chinese Yuan (RMB) moves constantly. Sometimes it feels like a rollercoaster. You worry that you might sign a contract at one price, but by the time you pay, the real cost has changed.

Currency fluctuations directly impact the cost of imports. While contracts are usually in USD, if the Chinese RMB strengthens significantly, suppliers may raise prices on future quotes to maintain their margin. To manage this, Proforma Invoices usually have a validity of 3 to 7 days. Alternatively, we can settle directly in RMB (CNY) to avoid this risk.

This is a factor that destroys profits silently. Tinplate is a product with high volume but low profit margins. A currency fluctuation of just 2% can wipe out the entire profit for a manufacturer or a trader.

The "Valid for 5 Days" Clause

When you receive a Proforma Invoice 9 (PI) from me, you will see a small note at the bottom: "Valid for 5 days." I am not trying to rush you. I am protecting both of us.

Steel prices change daily. Exchange rates change every minute.

- For T/T Orders: We lock in the exchange rate on the day we receive your deposit. If the rate moves after that, it does not affect your price. The price is fixed.

- For L/C Orders: Because it takes time to open an L/C, we usually build a small buffer into the price to account for potential currency swings during the processing time.

Paying in RMB: A Smart Strategy

Recently, more of my clients from Thailand, Russia, and South America are asking to pay in Chinese Yuan (CNY/RMB). This is a very smart move.

| Currency | Advantage | Disadvantage | Recommendation |

|---|---|---|---|

| US Dollar (USD) | Globally accepted. Fast banking. | Subject to US policies. High volatility. | Standard for most international trade. |

| Chinese Yuan (CNY) | Eliminates exchange risk for supplier. Better pricing. | Can be harder to buy CNY in some countries. | Best for buyers who want stable long-term prices. |

| Euro (EUR) | Convenient for European buyers. | Conversion costs in China are slightly higher. | Good for EU, but CNY is often better. |

Why RMB Settlement Can Be Cheaper

If we trade in USD, I (the seller) take the risk that the dollar will drop in value. To protect myself, I might add a small "safety margin" to the price.

However, if you pay me in RMB, I have zero exchange rate risk. I do not need that safety margin. I can pass those savings to you. Often, this can result in a price reduction of 0.5% to 1%.

Furthermore, for long-term contracts, we can use Forward Contracts 10. If you think the USD will get stronger or weaker, we can talk to the bank to "lock" a rate for 6 months. This requires us to communicate very openly. In a market full of uncertainty, being transparent about currency risk is the best way to ensure neither of us loses money to the forex market.

Conclusion

Payment terms for tinplate are not rigid rules; they are a measure of our trust. From the initial T/T deposit to the security of an L/C, and finally to the flexibility of O/A, each step reflects a deeper partnership. At Huajiang, we offer flexible solutions, provided the transaction remains safe and fair. Choose the term that fits your stage of business, and let your capital drive your growth, not hold you back.

Footnotes

1. Definition of cash flow and its importance in business. ↩︎

2. Overview of tinplate manufacturing and properties. ↩︎

3. Understanding electronic funds transfer methods and speeds. ↩︎

4. Common discrepancies in trade finance documents explained. ↩︎

5. Technology for imaging printing plates directly from computers. ↩︎

6. Explanation of easy-open mechanisms for metal packaging. ↩︎

7. Official site of China’s state-funded export insurance agency. ↩︎

8. Importance of verified financial statements for credit assessments. ↩︎

9. Purpose of a preliminary bill of sale in trade. ↩︎

10. Hedging tool to lock in future currency exchange rates. ↩︎